A chargeback is a process that allows cardholders to request a refund from their bank for a debit or credit card transaction. There are YouTube & TicTok videos telling people how they can have what they want and still get their money back! Unfortunately, fraudulent chargebacks, better known today at Chargeback Schemes, against our hardworking merchants is one of the fastest growing frauds in the United States!

In 2023, the US had approximately 105 million chargebacks costing the US Businesses an estimated $243 billion in lost revenue. Aside from the lost revenue, merchants also had to pay between $15 – $100 per chargeback in legal fees! Unless merchants become more SAVVY, this trend will continue and is expected to increase to 42% of all sales are disputed to about $337 million in lost revenue by 2026!

We need to stop this insanity, but how?

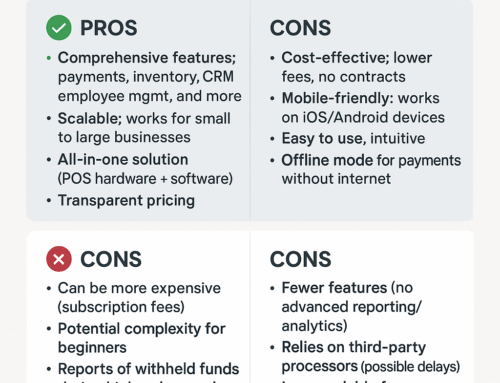

- The best means of accepting a transaction is in-person. Tapped and chipped transactions cannot be disputed! The devices used for the tap & chip are Tokenized and create a secure transaction. These are VERY DIFFICULT for a customer to dispute.

- Key-entered transactions via Website, over-the-phone, QR Code, Payment Link are hard for the merchant to fight! A customer can file a dispute by saying it was not me “not be them”, “my card was stolen” and a variety of other excuses to get their money back!

- Chargebacks can be used for a variety of reasons, including:

- The cardholder didn’t receive the goods or services they paid for

- The goods or services were defective, counterfeit, or faulty

- The cardholder was charged the wrong amount or twice by mistake

- The cardholder was charged for a repeat payment after canceling a subscription

- The cardholder believes the transaction was fraudulent

- The cardholder disputes the quality of the merchandise

HOW TO FIGHT FOR YOUR MONEY!

- Know when you’ve received a chargeback – when you set up your merchant account, find out how you will be notified of any chargebacks. Some companies send letter while others send email notifications and others notify within their POS System.

- Check the reason code – type in: Chargeback reason code list and check out the code#

- Check the expiration date – you only have a window of time to response to the chargeback

- Check the ROI – Remember the chargeback will cost you the dispute fees and the lost revenue, is it worth the time?

- Collect compelling evidence – collect signed documents, receipts, invoices, emails, text that corroborates your side of the dispute

- Write a great rebuttal letter – tell the “judge” why you should keep your hard-earned money!

- Submit your response – fax, upload to a website, mail in or whatever the notification says you need to do to get your dispute response to the bank within your allotted time.

If you need any help with staying ahead of chargebacks, Merchant Processing Solutions would like to review your processing systems to see how we can better serve your needs while retaining higher revenue.

Call us today @ 954-938-2420

Merchant Processing Solutions Inc.